Introduction

The fintech (financial technology) industry has transformed the global financial system by introducing digital innovation into traditional financial services. From mobile banking and digital wallets to blockchain systems and AI-powered financial platforms, fintech has redefined how individuals and businesses interact with money.

As the world moves toward 2035, fintech is no longer just a technology trend—it is becoming the foundation of modern financial infrastructure. Financial services are rapidly shifting from physical institutions to digital ecosystems, driven by innovation, automation, and connectivity. This article provides a complete informational overview of fintech industry growth, market size, and major trends shaping the future up to 2035.

Understanding the Fintech Industry

Fintech refers to the integration of technology into financial services to improve efficiency, accessibility, security, and user experience. It includes digital platforms that deliver financial products without relying on traditional banking structures.

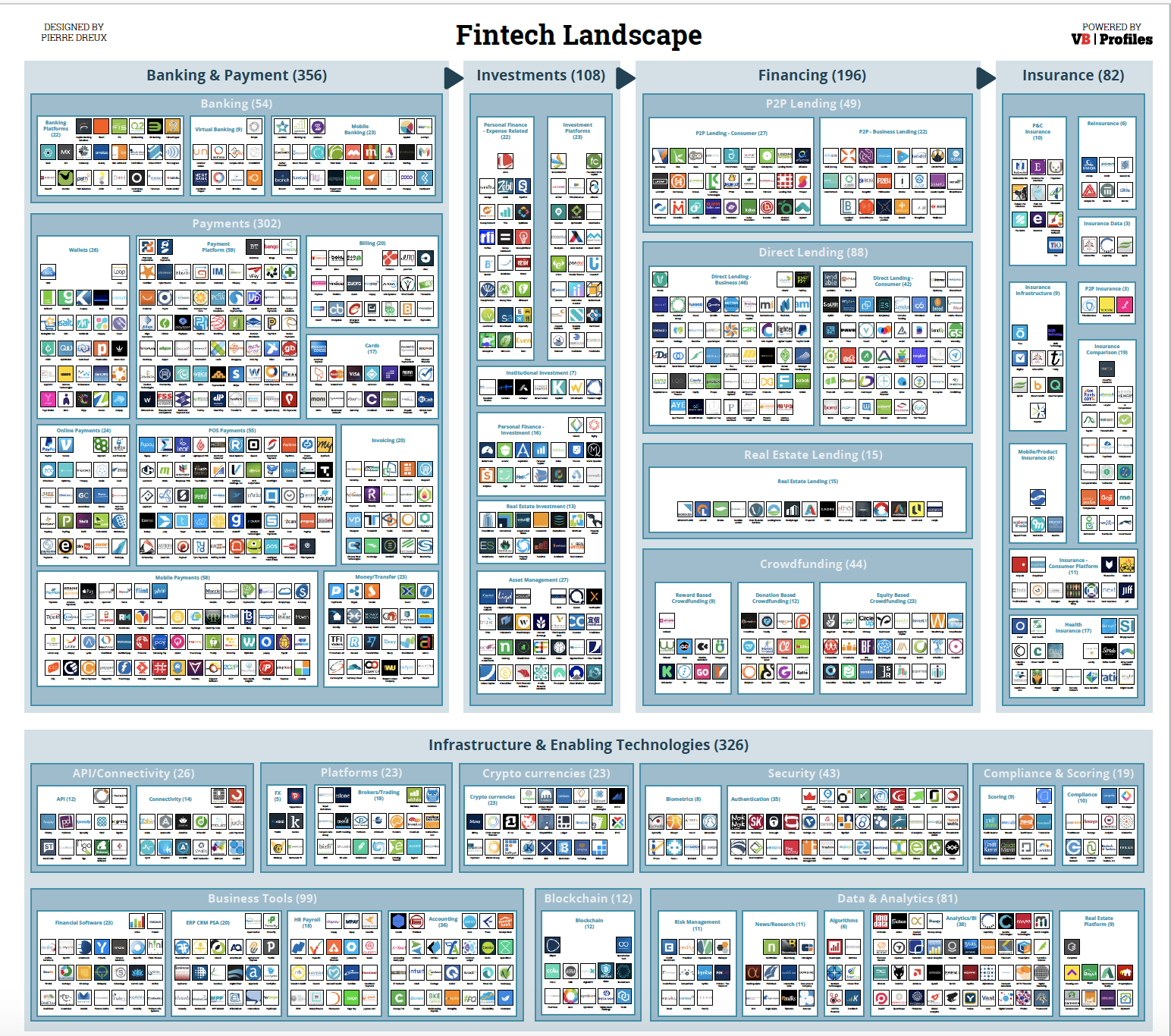

Core Areas of Fintech:

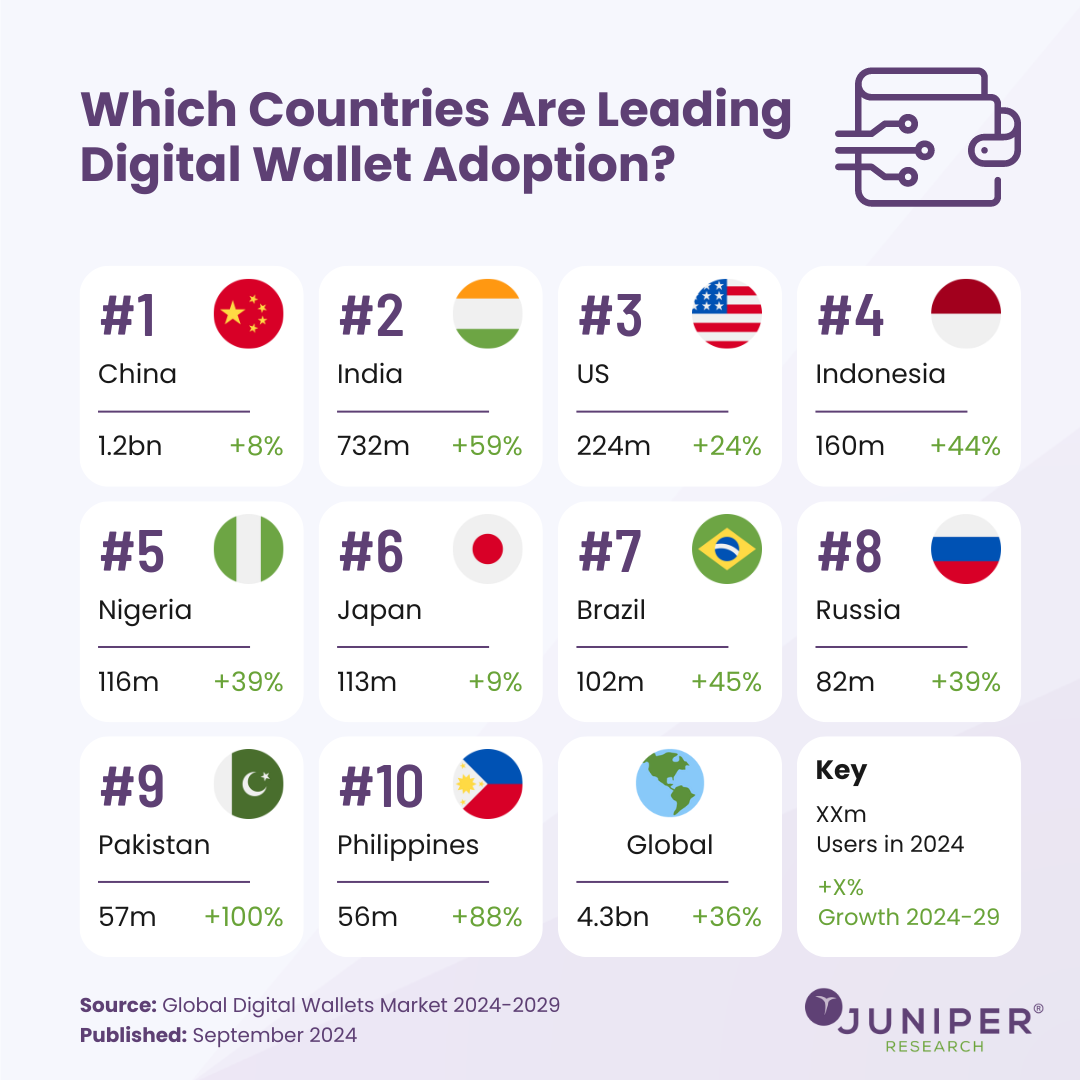

- Digital payments and wallets

- Online and mobile banking

- Blockchain and cryptocurrencies

- Peer-to-peer lending

- Insurtech (insurance technology)

- Wealthtech (investment platforms)

- Regtech (regulatory technology)

Fintech aims to simplify financial processes, reduce costs, and expand access to financial services globally.

Global Fintech Industry Growth

The fintech industry is experiencing rapid global expansion due to digital transformation across all financial sectors.

Major Growth Drivers:

Digital Transformation

Banks and financial institutions are shifting from physical branches to digital platforms, enabling faster and more efficient services.

Technology Adoption

Cloud computing, AI, blockchain, and big data analytics are driving innovation in financial services.

Consumer Behavior Shift

Customers prefer fast, contactless, and digital financial services, increasing fintech adoption.

Business Digitalization

E-commerce, SaaS platforms, and global digital trade rely on fintech infrastructure.

Government Support

Many governments support fintech development to improve financial inclusion and economic efficiency.

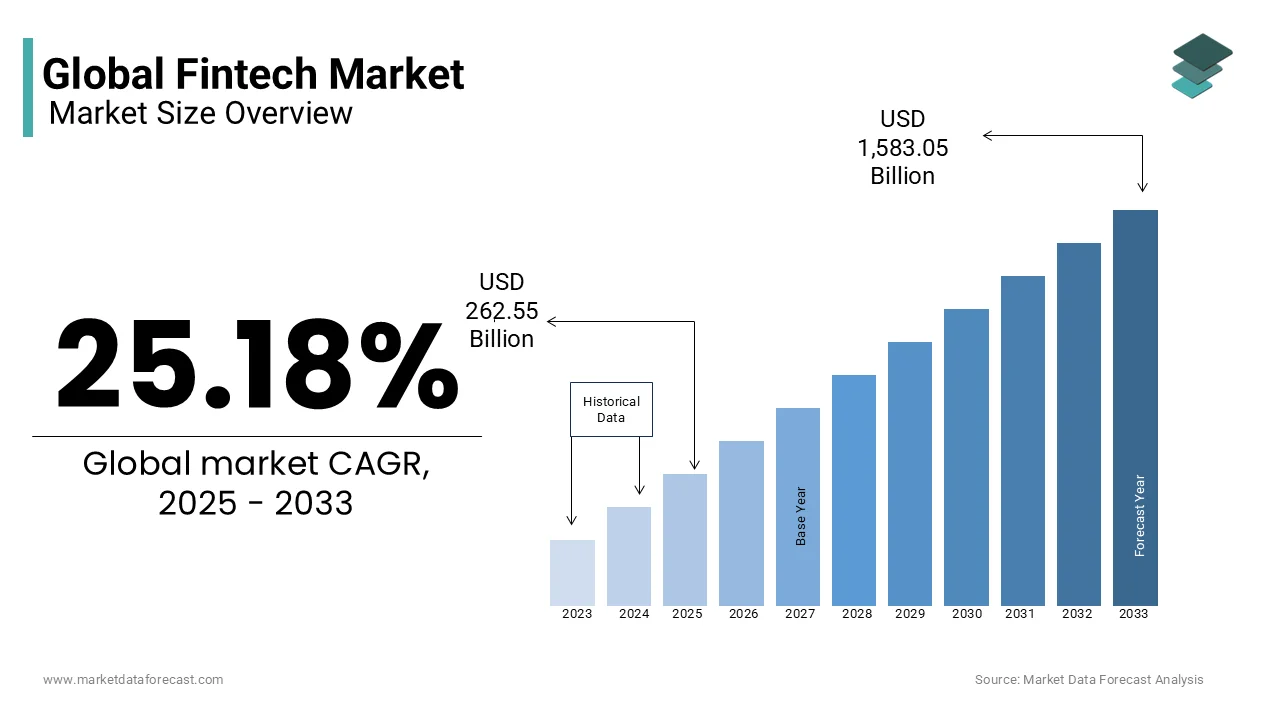

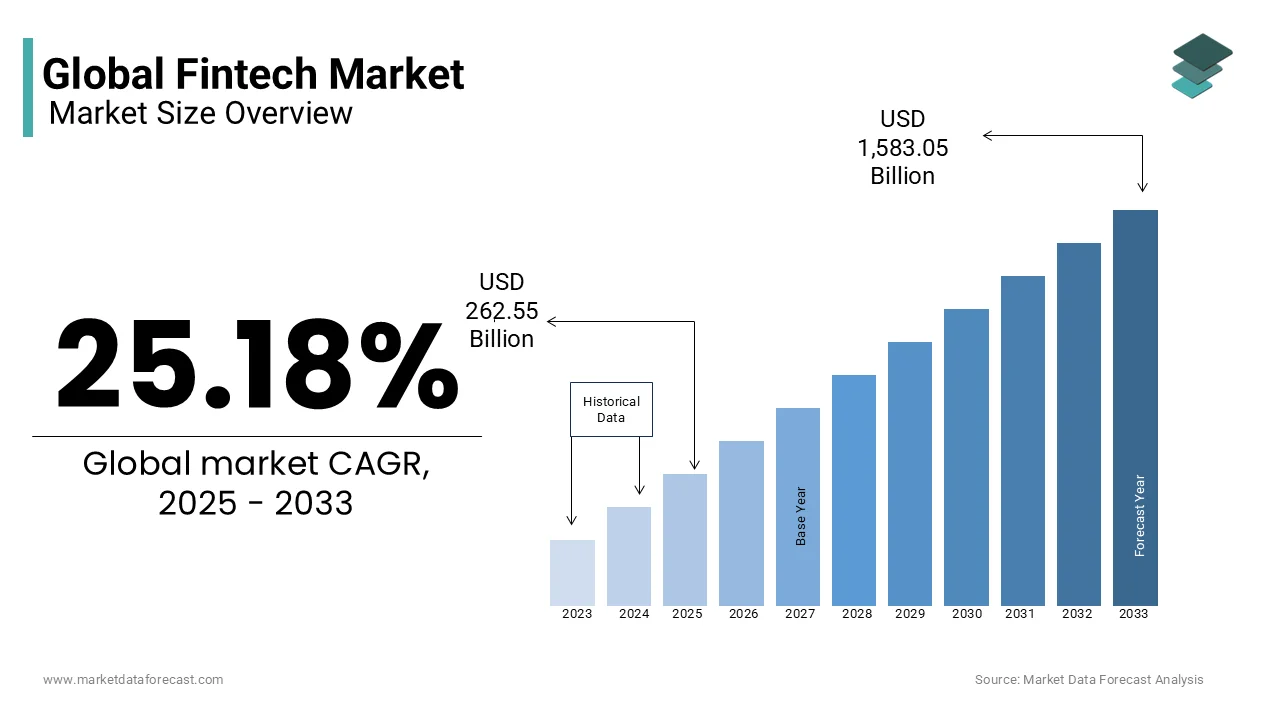

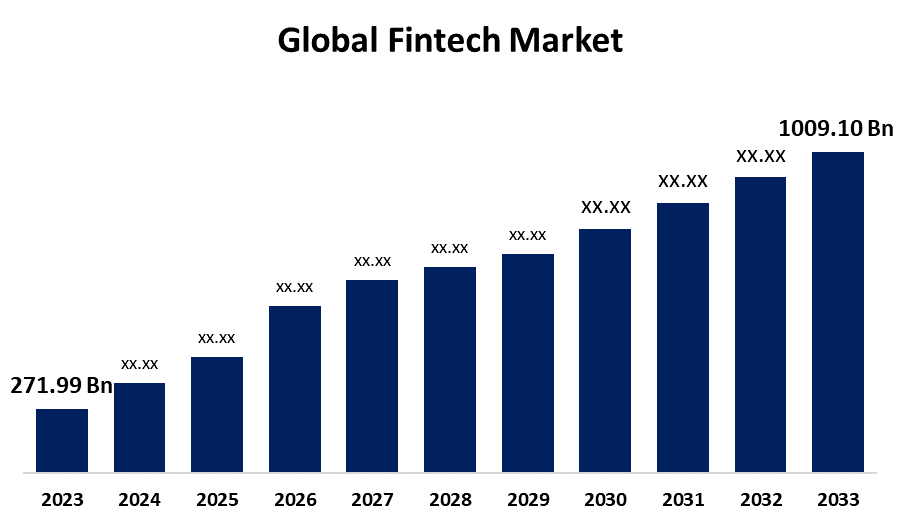

Fintech Market Size Outlook to 2035

The global fintech market is projected to grow significantly by 2035, driven by digital payments, AI finance, blockchain systems, and embedded financial services.

Market Expansion Areas:

- Cross-border digital payments

- Embedded finance in apps

- AI-powered financial automation

- Smart contracts

- Digital identity systems

- Decentralized finance platforms

Sector Growth Outlook:

| Fintech Sector | Growth Potential |

|---|---|

| Digital Payments | Very High |

| AI Finance Systems | Very High |

| Blockchain & DeFi | High |

| Open Banking | High |

| Insurtech | Medium–High |

| Wealthtech | High |

| Regtech | Medium |

By 2035, fintech will become a core financial infrastructure, not just a standalone industry.

Key Fintech Trends Shaping 2035

Artificial Intelligence in Finance

AI will automate fraud detection, customer service, financial planning, risk analysis, and investment decisions.

Blockchain and Decentralized Finance

Blockchain technology will create transparent and secure financial systems without intermediaries.

Embedded Finance

Financial services will be built directly into digital platforms such as e-commerce apps and social platforms.

Open Banking

Secure data sharing will allow personalized financial services and better credit systems.

Digital Identity Systems

Secure identity verification will reduce fraud and simplify access to financial services.

Green Fintech

Sustainable finance solutions will support climate-friendly investments and carbon tracking.

Central Bank Digital Currencies

Digital national currencies will integrate with fintech platforms for faster payments.

Regional Fintech Growth

North America

Leader in AI finance, digital banking, and innovation ecosystems.

Europe

Strong regulatory frameworks and open banking systems.

Asia-Pacific

Fastest-growing region due to mobile payments and super-apps.

Middle East

Rapid digital banking and blockchain adoption.

Africa

Fintech driving financial inclusion through mobile money services.

4

Fintech and Financial Inclusion

Fintech is transforming access to financial services for unbanked populations by providing:

- Mobile wallets

- Microfinance services

- Digital savings platforms

- Online credit access

- Secure payment systems

Business Impact of Fintech Growth

Fintech enables businesses to operate more efficiently through:

- Automated transactions

- Global payment systems

- Smart accounting

- AI financial analytics

- Digital payroll systems

- Subscription billing platforms

Companies using fintech gain speed, scalability, and competitive advantage.

Investment Opportunities in Fintech

High-growth investment areas include:

- AI finance platforms

- Blockchain infrastructure

- Digital identity systems

- Cybersecurity fintech

- Green finance technology

Fintech remains one of the most attractive long-term investment sectors.

Challenges Facing the Fintech Industry

Despite growth, fintech faces:

- Cybersecurity threats

- Data privacy issues

- Regulatory complexity

- Digital fraud risks

- Infrastructure gaps

- User trust challenges

Solving these challenges will define fintech sustainability by 2035.

Future Outlook of the Fintech Industry

By 2035, fintech will:

- Replace traditional banking systems

- Enable borderless finance

- Power digital economies

- Support smart cities

- Drive sustainable development

- Integrate finance into daily digital life

Fintech will become the foundation of the global digital economy.

Conclusion

The future of finance is digital, intelligent, and inclusive. The fintech industry growth, market size, and trends toward 2035 show a world where financial services are seamlessly integrated into everyday life. AI, blockchain, embedded finance, and digital currencies will reshape how money moves across the world.

Fintech is not just changing finance—it is redefining the global economic structure for the digital age.

Visit site: vyvymangatech.com

Leave a Reply

View Comments